An AI driven holistic bespoke Wealthtech

platform for everyone

Problem

- High initial portfolio and investment amounts

- High management fees and hidden costs

- Consumer lack of financial know-how

- Passive reaction to global events

- Model portfolios for customers

Solution

- Low initial portfolio and investment amounts based on investor type

- Competitive all inclusive management fees

- Agile portfolio management with automated rebalancing

- Dedicated section to encourage financial education

- Unique and hyper-personalised portfolios for customers

Key Features

2

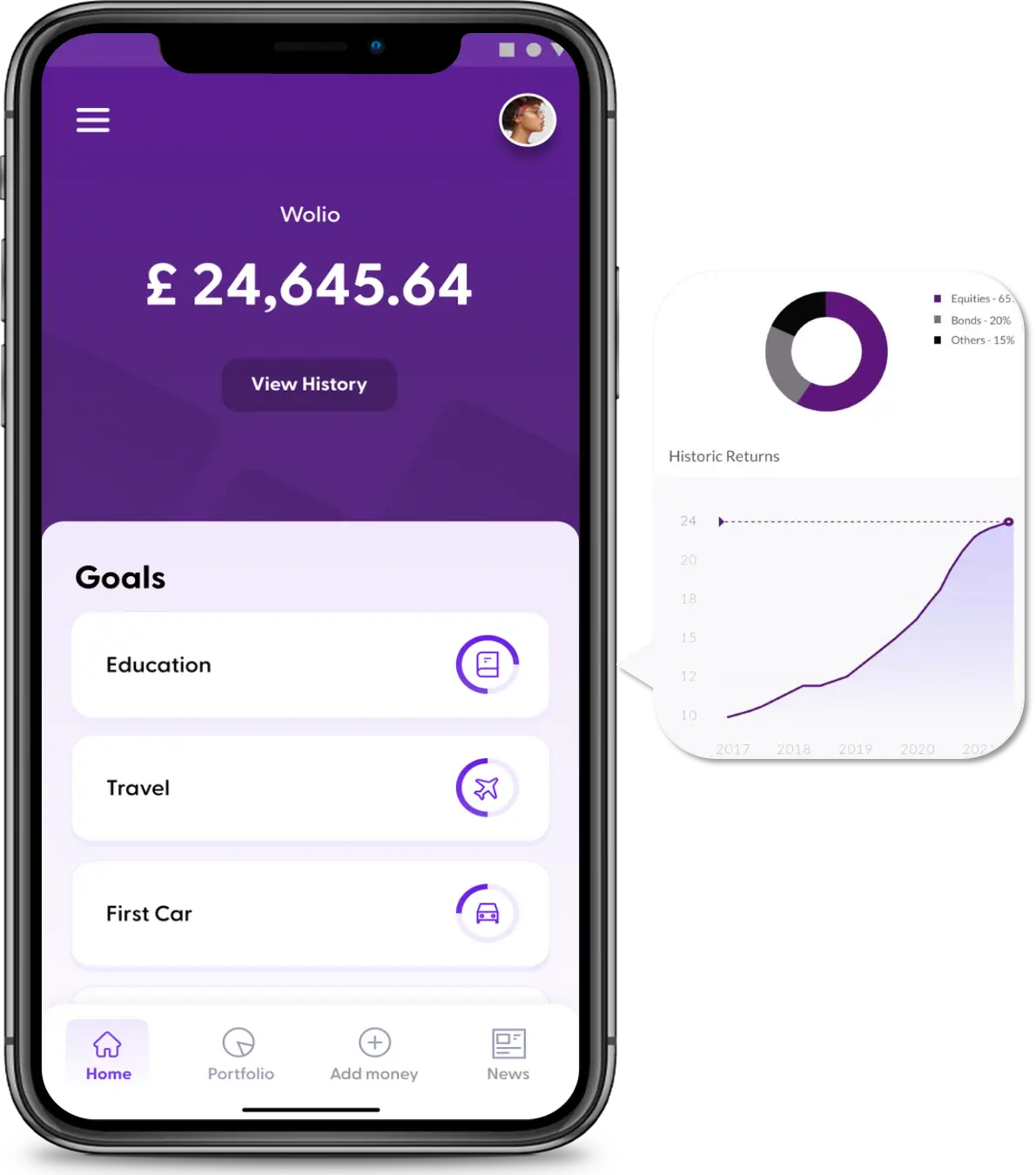

Hyper personalised

risk profiling and

portfolio recommendations

Based on

individual profiles,

needs and goals

4

Predictive

life financial

planning for all life stages

Smart Investment

suggestions based

on age and life stages

3

Sustainable

Investing

Clean portfolios

with an option

to optimise sustainability

1

Low fixed

fees and starting

investment amounts

Low and categorised

beginner investment

amounts with minimal fees

5

Active

Portfolio

Recommendations

Round the clock

automated portfolio

management using AI

%20(1).webp)

%20(1).webp)

%20(1).webp)

Value Proposition

Access to complementary financial platforms

Offering access to banking, life assurance and crowdfunding to provide the customers seamless end to end financial services.

Financial Education

Empowering and educating investors to plan their financial future through behavioural predictive financial planning and a dedicated financial education section.

Values

Planet

Measure, mitigate and offsetting environmental impact of the company and the users by providing clean only portfolios and an option to optimise sustainable investments

People

Providing financial inclusivity by demystifying and increasing access to financial planning tools thereby encouraging financial freedom and control

Profit

Reducing costs by deploying emerging technology and minimising human involvement as well as aiming to provide above market rate returns to investors

Register To Receive Priority Access

Contact Us

+44 20 3907 3840

Gibraltar Address: 2 Irish Town, Gibraltar, GX11 1AA

UK Address: 16 Berkeley Street, Mayfair, London W1J 8DZ

Ribbon Wealthtech Plc, Company Number: 120409, operating under the brand name Advsr, is an incubation by Red Ribbon Asset Management Plc,

a Mainstream Impact Investment company, following the principles of the ‘Triple P Bottomline’ arising from Planet, People and Profit.

© Advsr 2025. All rights reserved.